Ryan Republican Plan on Medicare Will Obliterate Americans' Retirement Savings

WASHINGTON – House Democrats came together on Tuesday for a Steering and Policy Committee hearing to examine how the House Ryan Republican plan for Medicare would impact seniors today and in the future. Expert witnesses and ordinary Americans at or near retirement testified that the House Republican Leadership’s proposal would not only end Medicare as we know it but, in doing so, would lead to significant increases in their health expenses and devastate their retirement savings.

“Here’s what we learned about the Ryan plan to end Medicare as we know it at a hearing earlier this week: It’s also a plan to obliterate middle class families’ own retirement savings,” said Rep. George Miller (D-Calif.), the co-chair of the committee. “Under the Ryan plan to end Medicare as we know it, seniors will have to pay thousands more per year to keep the same health care coverage they expected to receive before the Ryan plan would end Medicare as we know it.

“This would have a disastrous impact on seniors’ health care and financial wellbeing but also on all Americans’ retirement security. If you have a retirement nest egg, it will now be used to pay for their plan to end Medicare as we know it. That’s why AARP opposes the Ryan plan. That’s why a majority of seniors oppose it and that’s why I oppose the Ryan Republican plan to end Medicare as we know it.”

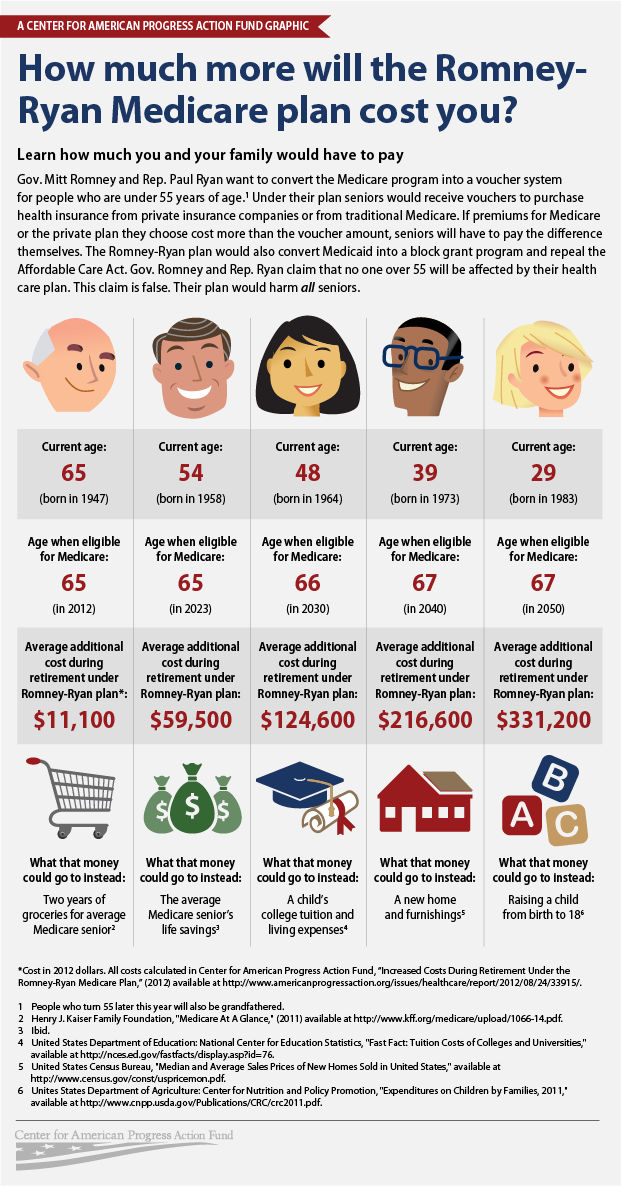

Fact 1: If you are on Medicare now, the Ryan Republican budget plan will make you shell out $11,000 more of your own money to pay for more expensive prescription drugs and copays for routine preventive health screens.

Fact 2: If you are relatively near retirement (say, 54 years old), you will have to find around $59,500 to sock away to make up the difference in what you expected to get in Medicare benefits and what you would actually get under the Ryan plan to end Medicare as we know it. Money that would have been saved for a retirement nest egg would now be eaten up to cover these added health care costs.

Fact 3: If you are far away from retirement, you will have to find a lot more money than that to make up the difference. Thirty-nine-year-olds, for example, need to save an extra $216,600, by the time they retire, just to pay for health care. For 31 year-olds, you’re going to have to find an extra $331,200. That 401(k) you have? That’s going to pay for basic health care instead of securing your long-term retirement.

“Americans need to know the facts on this critical public policy issue,” Miller said. “Their health and financial security depend on it.”

Next Article