Miller Urges Immediate House Passage of Senate Student Loan Bill

WASHINGTON – In a letter sent to Speaker John Boehner today, U.S. Rep. George Miller (D-Calif.) urged immediate consideration and passage of the Bipartisan Student Loan Certainty Act, the bipartisan Senate legislation that would reverse the July 1 student loan interest rate hike.

“Mr. Speaker, the House passed a bill that was detrimental to students and families. The Senate has passed a bill that helps students and families afford college as they climb out of a deep recession,” wrote Rep. Miller. “It delivers real relief to millions of Americans as they struggle to pay for a college education over the next few years. I hope you will drop your support of the House bill and move immediately to pass the Senate bill. Let’s send this measure to the President’s desk for his signature.”

In May, the House passed a bill, H.R. 1911, that makes college more expensive for students and families. The GOP’s H.R. 1911 would increase students’ total debt burden by billions of dollars, and a Congressional Research Service (CRS) analysis shows that the proposal is even worse for students than the 6.8 percent rate that took effect on July 1 for subsidized Stafford loans. It continues to be a nonstarter for congressional Democrats and President Obama, who has threatened to veto that House GOP bill.

The bipartisan legislation passed today by the Senate, originally introduced as S.1334 but passed as an amendment to H.R. 1911, benefits students and families in a number of ways including:

- The Bipartisan Senate Bill Provides Students $25 Billion in Debt Relief Over the Next Six Years.

Under the Senate bill, college students and their families would save $25 billion in lower interest costs from 2013-2018, compared to current interest rates. By contrast, the House Republican passed plan (H.R. 1911) costs students $1 billion over the same period of time.

- The Bipartisan Senate Bill Allows Students and Families Battered by the Great Recession to take Advantage of Today’s Historically Low Interest Rates.

The Senate bill allows students to lock in today’s historic low interest rates for the life of the loan and ‘know what they owe’ before signing on the bottom line. By contrast, the House Republican bill provides a teaser rate today but balloons in future years on the same loans as interest rates rise, leaving students guessing what they will owe.

- The Bipartisan Senate Bill Allows Rates on Every Single New College Loan to Come Down this Year for Nearly 11 Million Borrowers.

This year, under the Senate bill, an undergraduate with an average loan will save nearly $1,500 in interest over the life of that loan. Undergraduates will borrow at 3.86 percent, a cut from 6.8 percent. Graduate students will borrow at 5.4 percent, a cut from 6.8 percent. Parents and graduate students borrowing PLUS loans will borrow at 6.4 percent, a cut from 7.9 percent. By contrast, under the House Republican bill, an incoming freshman entering repayment after five years of loans would be charged a 7.45 percent interest rate on loans taken out this year – a higher rate than current law’s 6.8 percent rate.

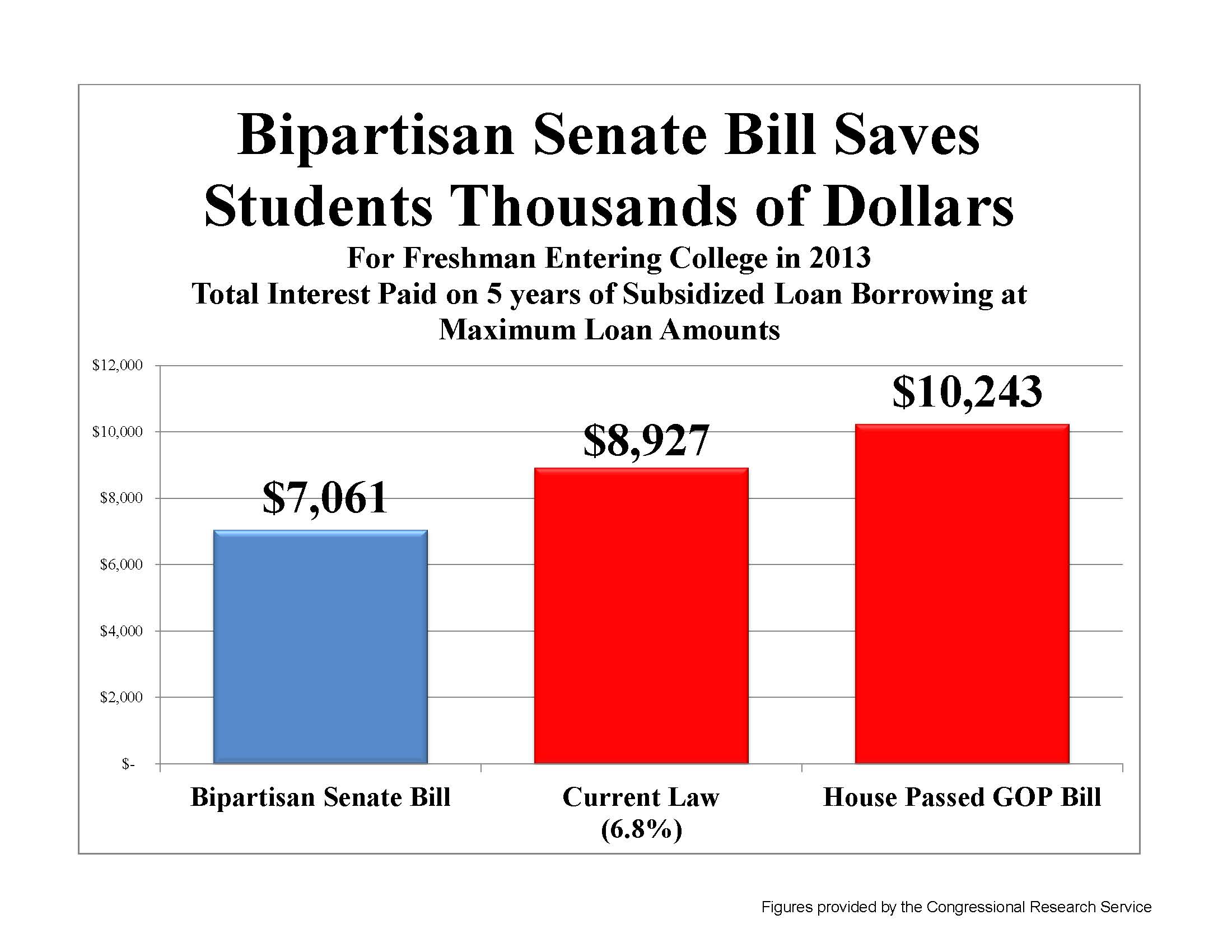

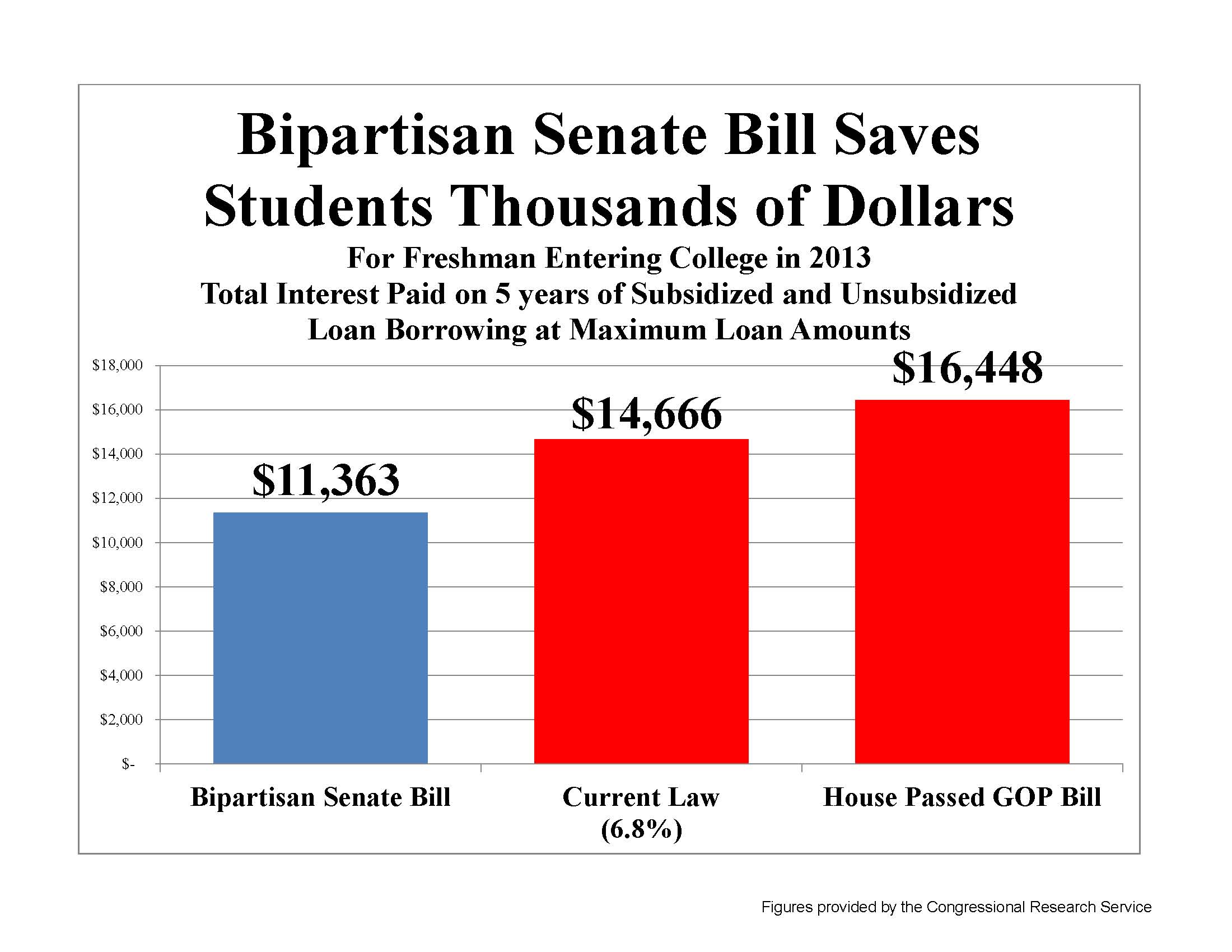

According to CRS, the bipartisan Senate bill saves students thousands of dollars in lower interest payments over the next several years compared to current law. By contrast the House Republican-passed bill would cost students thousand more than current law and the Senate-passed bill. The figures below are based on a standard repayment period of ten years:

Freshman starting college next year who borrow the maximum amount of subsidized Stafford loans over five years would pay $10,243 in interest under the Republican passed bill, $8,927 if subsidized loans were kept at 6.8 percent, or $7,061 under the bipartisan Senate proposal.

Freshman starting college next year who borrow the maximum amount of subsidized and unsubsidized Stafford loans over five years would pay $16,448 in interest payments under the Republican passed bill, $14,666 if rates were kept at 6.8 percent or $11,363 under the bipartisan Senate proposal.

Read Rep. Miller’s letter to Speaker Boehner below.

Dear Speaker Boehner:

The Senate has just passed a bipartisan bill to reverse the recent student loan interest rate hike. I am writing to urge you to bring this bill – the Senate amendment to H.R. 1911 – directly to the House floor for a vote and to pass it without delay.

As you know, due to Congressional inaction, interest rates doubled on subsidized student loans on July 1st. The House majority passed a partisan bill in June purporting to stop the rate hike, but that bill, H.R. 1911, was dead on arrival in the Senate. Enacting the House-passed bill would have inflicted more harm on students and families than allowing the rates to double. In its first five years, it would have increased total student loan debt by approximately $1 billion. Over the 11 year budgetary window, it would have raised student debt by $3.7 billion. The House-passed H.R. 1911 used adjustable rates – a bait-and-switch that we saw devastate Americans who took on adjustable rate mortgages during the housing boom. Students would sign up for a loan at one rate but be subjected to a different rate that ballooned yearly even through repayment. For example, an incoming freshman this year would be lured into borrowing under today’s low rates, but over time the interest on the same loan would balloon to a projected 7.45 percent when she enters repayment five years later.

The Senate, by contrast, undertook serious bipartisan negotiations. Those talks have produced a solution that the House should take up immediately. The Senate bill rejects the House majority’s insistence on massive deficit reduction on the backs of students. In its first five years, the Senate bill will lower student loan interest rates providing students and families $25 billion in student debt relief. This year, an incoming freshman can borrow loans at a 3.86 percent interest rate on both subsidized and unsubsidized Stafford loans and continue to borrow at rates below current law through their academic career. The same student making full use of the Stafford loan program stands to save over $3,300 compared to current law. That savings will provide critical relief for families just emerging from the worst recession since the Great Depression, who experienced bouts of unemployment, tightened belts, and loss of savings just as they prepare to send their children to college. Additionally, in contrast to the House bill, borrowers will know what they will owe when repaying their loans under the Senate bill. The Senate bill’s rates are fixed for the life of the loan. Moreover, Senate Democrats successfully included a cap on interest rates, to protect students and families from any potentially skyrocketing rates in the future.

Enactment of the Senate bill in no way means our work is done. This bill helps reduce costs to students and families, but it does not solve the long-term student loan debt crisis. It does not eliminate the significant profits currently collected by the federal government from student loans. Accordingly, I remain committed to keeping interest rates down and to addressing college cost as a whole. It’s my goal to make sure every American who wants to go to college has access to an affordable and high-quality higher education. Through the reauthorization of the Higher Education Act, Congress must enact reforms to drive down the underlying cost of college and, if rates should climb unacceptably, revisit the Senate bill’s provisions.

Mr. Speaker, the House passed a bill that was detrimental to students and families. The Senate has passed a bill that helps students and families afford college as they climb out of a deep recession. It delivers real relief to millions of Americans as they struggle to pay for a college education over the next few years. I hope you will drop your support of the House bill and move immediately to pass the Senate bill. Let’s send this measure to the President’s desk for his signature.

Next Article