New Analysis: Failing to Raise the Debt Ceiling Could Make College More Expensive for Nearly 9 Million Students

With the debt ceiling deadline just one day away, the Institute for College Advancement and Success (TICAS) is out with new figures on the potential impact a federal government default would have on college students across the country taking out student loans. From TICAS:

For a college freshman who starts school in fall 2014, takes out the annual maximum in subsidized and unsubsidized Stafford loans, and graduates in four years, [a federal default] will increase the cost of college by about $1,000.

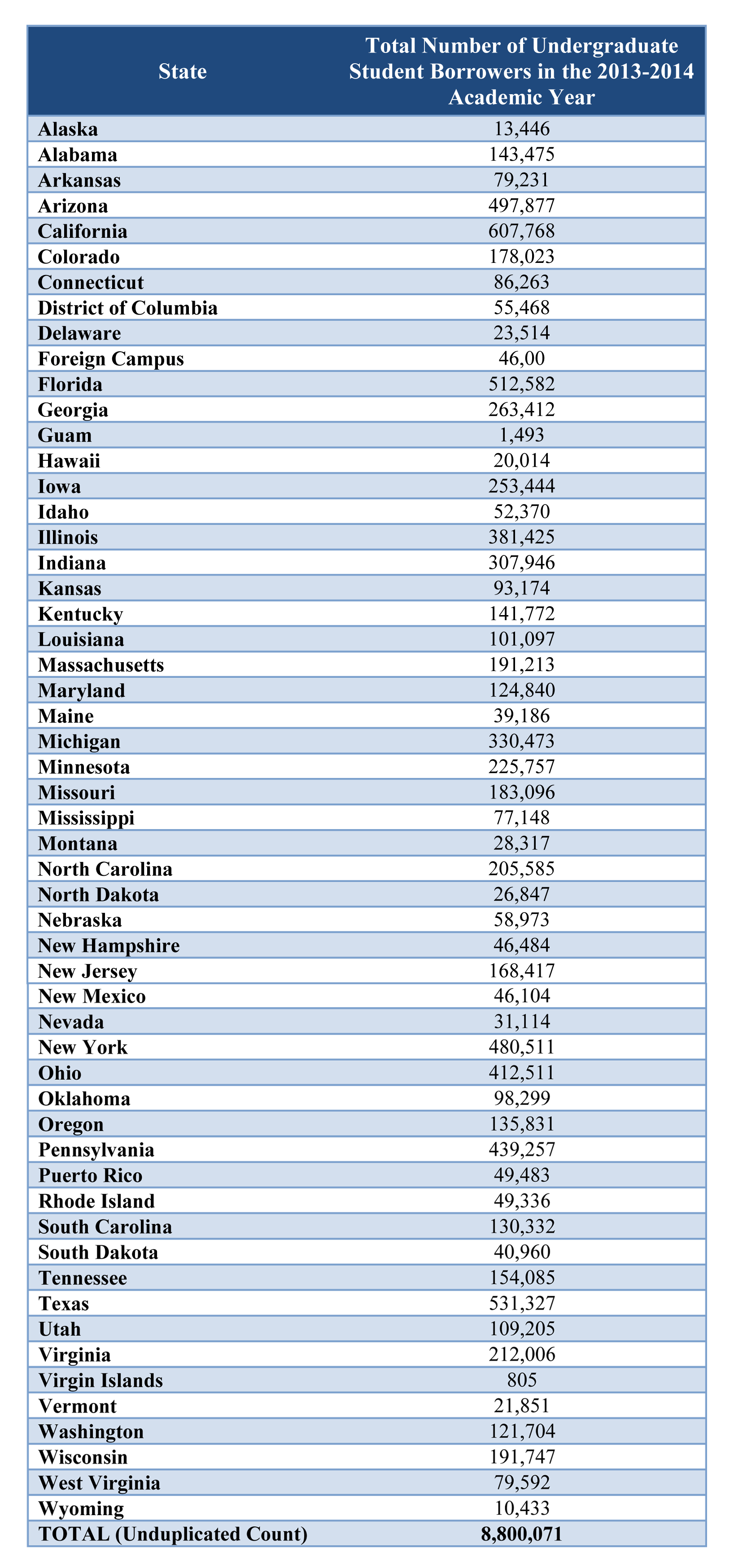

A federal government default could cause interest rates to increase by .5 to 1 or more. This $1,000 increase would affect nearly 9 million undergraduate students in the 2013-2014 academic school year. If Congress failed to resolve raising the debt ceiling quickly, a prolonged default could increase student loan payments by $2,000.

Now more than ever American students need Congress' help to afford the cost of a college education. Making a college education more affordable is the right thing to do for the nation’s long-term prosperity. Unfortunately, failing to raise the debt ceiling would put a college degree and access to the middle class further out of reach for millions of young people.

For a state-by-state breakdown on the impact a federal government default could have on undergraduate students click here.