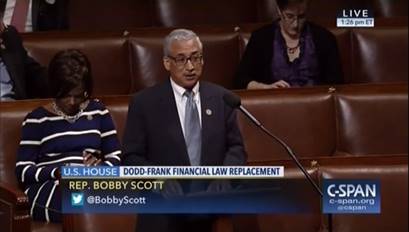

Ranking Member Bobby Scott Opposes the #WrongChoiceAct

H.R.10 undermines student loan borrowers and workers saving for retirement

H.R.10 eviscerates the Consumer Financial Protection Bureau (CFPB), which plays a pivotal role in making sure student loan borrowers are treated fairly and receive the protections they deserve. The Dodd-Frank Act established the CFPB, and it also created a student loan ombudsman within CFPB that is tasked with collecting and analyzing complaints submitted by both private and federal student loan borrowers. This crucial work has led to the CFPB taking concrete action to protect student borrowers such as issuing reports highlighting problems in loan servicing and default rehabilitation. In addition, H.R. 10 repeals the “fiduciary rule,” a responsible fix to the problem of “conflicted advice.” For too long, some financial advisors have been able to exploit loopholes in a decades-old regulation and put their profit motives ahead of their retirement clients’ best interests. This practice costs retirement plan participants $17 billion in losses every year according to President Obama’s Council on Economic Advisors.

Congress should not undermine or eliminate protections for students trying to finance a college education and workers planning for retirement. Unfortunately, that is precisely what H.R. 10 does.

Video: https://youtu.be/ipeGRvxY-hA